Calculate your tax

Based On Circumstances You May Already Qualify For Tax Relief. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Self Employed Tax Calculator Business Tax Self Employment Self

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as.

. How Income Taxes Are Calculated. Choose an estimated withholding amount that. Ad See If You Qualify For IRS Fresh Start Program.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. This includes all supporting documents such as forms that show your income and validate your deductions. That means that your net pay will be 43041 per year or 3587 per month.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. With graduated income tax rates from 2 to 49 for 2022 state taxes in Arkansas depend on your earnings according to a spokesperson for the Arkansas Department of. Free Case Review Begin Online.

Ad 40 Years of Lightning-Fast Filings. The easiest way to calculate your tax bracket in retirement is to look at last years tax return. See how your refund take-home pay or tax due are affected by withholding amount.

Enter some simple questions about your situation and TaxCaster will estimate your tax refund amount or how much you may owe to the IRS. All of your tax returns for seven years. This tells you your take-home.

Free Case Review Begin Online. Before-tax price sale tax rate and final or after-tax price. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports.

In a nutshell to estimate taxable. The calculator will calculate tax on your taxable income only. Your average tax rate is.

For 2020 look at line. You need to estimate the amount of income you expect to earn for. You can use the worksheet in Form 1040-ES to figure your estimated tax.

Use your prior years federal tax return as a guide. Tax credits and rate bands. Estimate your federal income tax withholding.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Your Tax Credit Certificate.

To calculate your Income Tax IT you will need to understand how tax credits and rate bands work. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying. Receive Personal Attention From a Knowledgeable Business Incorporation Expert.

Tax Caster App Review. Our tax calculator stays up to date with the. Based On Circumstances You May Already Qualify For Tax Relief.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. How to Calculate Your Tax Return. Enter your tax year filing status and taxable income to calculate your estimated tax rate.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. That means that your net pay will be 40568 per year or 3381 per month. Now Offering Even Lower Prices - Start Here.

7 rows Estimating a tax bill starts with estimating taxable income. Easily Approve Automated Matching Suggestions or Make Changes and Additions. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

W-2 1099s canceled checks receipts for. Estimate your us federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using irs formulas. 54 rows Sales Tax Calculator.

Ad See If You Qualify For IRS Fresh Start Program.

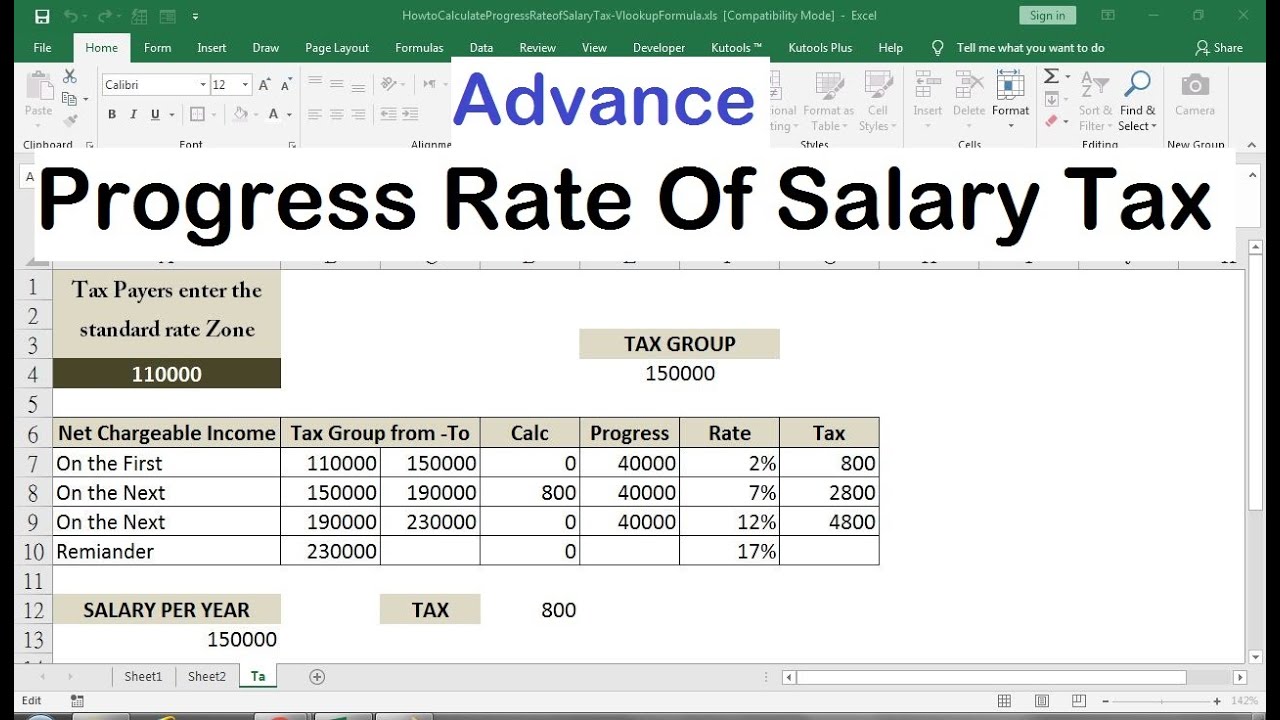

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

How To Create Excel Data Entry Form With Userform That Calculates Income Tax Full Tutorial Income Tax Excel Tutorials Income

Income Tax Calculator In India Calculate Your Income Tax For Fy 2019 20

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Income Tax Calculator App Concept Calculator App Tax App App

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

A Visual Representation Of How To Do Your Payroll Taxes Infographic Payroll Taxes Payroll Accounting Payroll

Know About Turbotax Deluxe Premium And Free Edition Calculator Turbotax Income Tax Return Calculator

Tax Calculator Calculator Design Financial Problems Calculator

Self Employed Taxes How To Calculate Your Tax Payments Business Money Tax Money Advice

Taxes And Fees Paying Financial Charge Obligatory Payment Calculating Personal Income Tax Doing Your Taxes Tax Credit Metaphors Ve Income Tax Tax Income

Income Tax Calculator For India Infographic Income Tax Income Budgeting Finances

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Tax Calculator Calculator Design Calculator Web Design

Calculate Your Effective Tax Rate When You Do Your Taxes This Year And Save That Of Net Income Each Month For Your T In 2022 Today Tips Mindfulness Coach Mindfulness

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure